Senior Accountant - Accounting and Tax Services

Job Description

We are seeking a full-time Senior Accountant with a minimum of 3-4 years experience in Accounting and Tax Services. Must be able to perform most work assigned with a minimum of assistance and lead staff accountants, instructing them in work to be performed, reviewing the work done (which includes workpaper documentation and financial statement preparation), and directing necessary revisions. The right candidate is able to make decisions on all but the most unusual accounting matters and have a solid understanding of tax regulations. When such problems arise, must be able to outline the issues for the supervisor, manager, or partner to consult on and then acts on that advice.

The ideal candidate is able to set up time budgets on jobs previously handled and can lead staff accountants to employ methods that will accomplish objectives timely, while displaying a professional conduct that shows confidence and ease in the presence of staff and client representatives.

Responsibilities

- Perform diversified accounting and tax assignments under the direction of supervisor, manager, and/or partner.

- Demonstrate competency in technical skills, work quality, and application of professional and firm standards. Takes ownership of projects and tasks.

- Meet time constraints, client deadlines and tax compliance deadlines.

- Participate in planning and scheduling of client engagements.

- Direct and instruct staff, where applicable, in work to be performed and completes technical workpaper review.

- Prepare workpapers and perform various procedures established under generally accepted accounting principles (GAAP) or other comprehensive basis of accounting (OCBOA) to facilitate proper financial reporting.

- Prepare basic to more complicated personal and corporate tax returns.

- Analyze IRS notices and drafts responses.

- Contribute to the client service team by producing quality work with quick turnaround and attentive service to clients and staff.

- Maintain contacts with peers and begins to develop a network of business contacts.

- Perform the broadest range of accounting tasks so that direct involvement of supervisors, managers, or partners is kept to a minimum.

- Prepare other reports, projects, and duties as may be assigned.

- Possess technical knowledge sufficient to supervise staff accountants.

- Have command of GAAP, other comprehensive bases of accounting, unique or specialized accounting principles, and financial statement presentations.

- Assume responsibility for efficiently supervising client engagements.

- Effectively communicate with clients to obtain information necessary to complete the engagements with a minimum of disruption to client.

- Possess knowledge in preparing payroll, as well as in preparing payroll tax and sales tax returns.

Desired Skills and Experience

- Bachelor’s degree or master’s in accounting.

- At least 3-4 years of experience in public accounting, demonstrating a progression in complexity of accounting tasks and tax knowledge.

- Either holds a current and valid certified public accountant’s license, or is working toward obtaining the license by taking and passing the applicable state CPA exam.

- Proficiency and experience using QuickBooks, CCH tax and accounting products, Creative Solutions Fixed Assets a plus.

For confidential consideration, please e-mail your resume to careers@zinnerco.com

OR mail it to the following address:

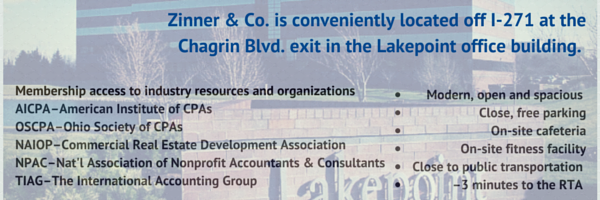

Zinner & Co. LLP

ATTN: Human Resources

3201 Enterprise Pkwy

Suite 410

Beachwood, OH 44122