In June, the American Institute of Certified Public Accountants held a virtual Not for Profit Conference, which discussed a range of issues including stimulus funding, changes to tax law, cybersecurity and changes to independent auditors report.

Posts By: Zinner & Co. Non-Profit Team

Cleveland COVID-19 Rapid Response Fund

Zinner & Co. Non-Profit Team non-profits , Coronavirus , COVID-19 , Cleveland COVID-19 Rapid Response FundIndividuals and Organizations Encouraged to Give

On March 18, Philanthropic partners across Northeast Ohio today announced the creation of the Greater Cleveland COVID-19 Rapid Response Fund, which will soon distribute grants to nonprofit organizations serving on the front lines of the pandemic throughout Greater Cleveland.

Contributions to the Rapid Response Fund now total $3.95 million from 18 different organizations.

Funding partners urge other foundations, corporate entities, individuals, and other organizations to contribute to the fund via ClevelandFoundation.org/Response. Donations of any amount are welcomed, and all contributions are tax deductible.

Initial support for the fund was made possible by:

Sue Krantz Completes Term on Rape Crisis Center Board

Zinner & Co. Non-Profit Team non-profits , Sue Krantz , not-for-profit , Cleveland Rape Crisis CenterZinner & Co. partner Sue Krantz, CPA, CGMA, recently completed her term on the Board of the Cleveland Rape Crisis Center.

For the past nine years, Krantz was honored to serve, most recently as Treasurer and a member of the Executive Committee.

“While my term has come to a close, I was proud and in awe of the significant accomplishments, which took place at CRCC while I was a member of the Board,” she said. “CRCC expanded its offices and staffing in order to improve access to its free services, which are now offered in four counties, in many regional satellite offices and at partner agency locations.”

Nonprofit Parking Tax Repealed

Zinner & Co. Non-Profit Team non-profits , non-profit reporting , not-for-profitRecently passed legislation will benefit nonprofit organizations by repealing an unpopular unrelated business income tax (UBIT) on expenses of nonprofits that provide transportation fringe benefits to their employees.

The “Parking Tax,” which was imposed under I.R.C. Section 512(a)(7) upon enactment of the 2017 Tax Cuts and Jobs Act, has now been retroactively repealed under the Taxpayer Certainty and Disaster Tax Relief Act.

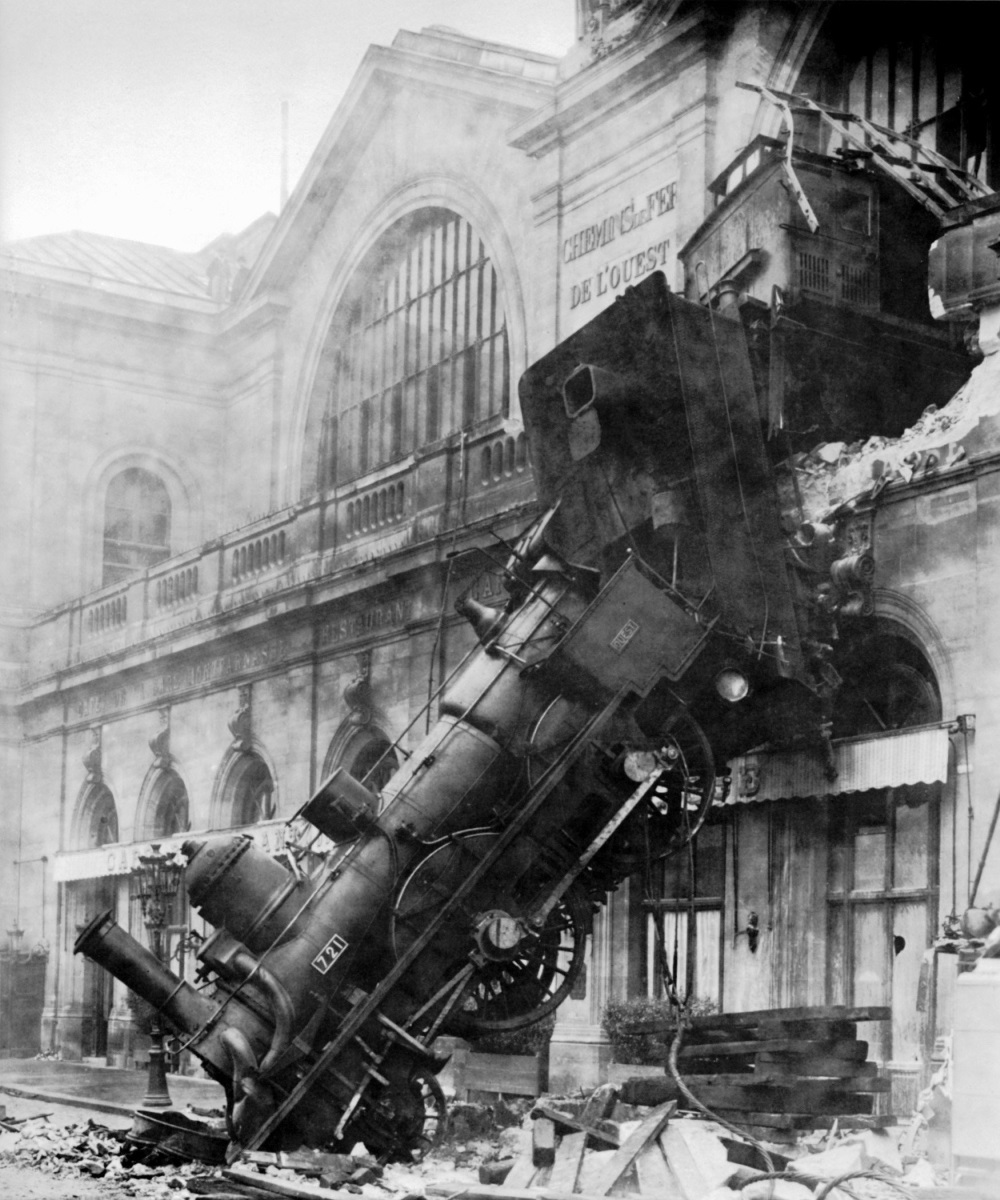

5 Reasons Your Non-Profit Organization Should Have a Crisis Communication Plan

Zinner & Co. Non-Profit Team non-profits , not-for-profit , Community , fundraisingA public relations disaster can bring any organization to it’s knees, and nowhere is this more true than not-for-profits. A critical component of surviving negative attention is responding to it in a thoughtful and timely way. One of the best ways to achieve this is to have a fully-developed crisis communication plan.

6 Quick Tips to Help You Promote Your Non-Profit Organization

Zinner & Co. Non-Profit Team non-profits , not-for-profit , Community , fundraisingOne of the hardest things about running a non-profit is getting the word out to prospective donors and constituencies about your mission and why donors should support your fundraising efforts. With many causes competing for prospective donors’ time and attention, it can be difficult to get and keep their interest.

Fundraising in a “New Age” Part 2

Zinner & Co. Non-Profit Team non-profits , not-for-profit , Community , fundraising Part 2 of a 2 Part Series - Read Part 1 Here

In the first part of this blog series, we looked at some of the reasons for changes in charitable giving trends. In this part, we’ll look at how non-profits should approach fundraising.

Fundraising in a New Age (Part 1)

Zinner & Co. Non-Profit Team non-profits , not-for-profit , Community , fundraisingFor not-for-profit organizations, fundraising is a way of life. It is vital part of fulfilling their mission and serving their constituency. Over the past few years, fundraising has changed appreciably and non-profits have been forced to find new/better/smarter ways of doing things.

Key Things You Need to Know About Directors and Officers (D&O) Insurance

Zinner & Co. Non-Profit Team non-profits , not-for-profit , InsuranceIf you’re on a Board of Directors, serve as an Officer or are on the executive team of a company or board of directors, there is a type of insurance you need to know about – Directors and Officers Insurance (known as D&O Insurance.)

11 Free (or Nearly Free) Software Solutions Every Non-Profit Should Know About

Zinner & Co. Non-Profit Team non-profits , not-for-profit , CommunityIf you manage a not-for-profit, you know you’re always trying to do more with less. You keep a tight budget and splurging on luxuries is out of the question. When it comes to software, there are a lot of great solutions that are free (or deeply discounted) for nonprofits.

About Us

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Categories

- 1031 Exchange (2)

- 401k (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (13)

- audits (8)

- Bank Secrecy Act (1)

- banks (1)

- Barbara Theofilos (6)

- Beneficial Ownership Information (1)

- Bitcoin (1)

- block chain (2)

- BOI (3)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (51)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Charitable Donations (2)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Compliance (1)

- Coronavirus (24)

- Corporate Transparency Act (1)

- COVID-19 (30)

- Credit card fraud (5)

- credit reporting (2)

- cryptocurrency (2)

- CTA (2)

- cybersecurity (17)

- dead (1)

- DeAnna Alger (6)

- death (2)

- debt (4)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (2)

- Digital Tax Payment (3)

- divorce (4)

- DOMA (3)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- EIDL (1)

- electronic filing (4)

- Electronic Tax Payments (3)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (3)

- Employee or Independent Contractor (6)

- Employee Retention Credit (3)

- employment (2)

- ERC (3)

- Eric James (8)

- Estates, Gifts & Trusts (48)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FASB (1)

- FBAR (1)

- FDIC coverage (1)

- Federal Assistance (4)

- filing (3)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- FMLA (1)

- foreign assets (3)

- fraud (38)

- FSA (1)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- HDHP (2)

- health care (3)

- home (2)

- home office (1)

- Howard Kass (2)

- HRA (1)

- HSA (5)

- identity theft (34)

- income (1)

- income tax (58)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- Intuit (1)

- investments (4)

- IRS (91)

- jobs (5)

- John Husted (1)

- K-1 (1)

- Laura Haines (3)

- Layoff (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- LLC (3)

- Loans (2)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- NAIOP (1)

- National Defense Act (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- OATC (1)

- OBBB (3)

- ODJFS (1)

- office (1)

- ohio (13)

- Ohio Accounting Talent Coalition (1)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (4)

- Ohio Department of Taxation (7)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Ohio Society of Certified Public Accountants (1)

- One Big Beautiful Bill (9)

- Online Tax Payment (4)

- Operations (2)

- OPERS (1)

- OSCPA (1)

- Overtime (1)

- owners of foreign entities (1)

- partnerships (5)

- passwords (1)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- ppp (7)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (14)

- record retention (2)

- records (2)

- Reporting (1)

- Republican National Convention (1)

- Retirement Planning & IRAs (54)

- Richard Huszai, CPA (5)

- RITA (1)

- Robin Baum (6)

- RRF (1)

- S Corporation (1)

- SALT (8)

- SBA (8)

- scams (14)

- SECURE 2.0 Act (1)

- security (6)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- SMB (12)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- spouse (1)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- SVOG (1)

- tangible property (1)

- tax (27)

- tax avoidance (12)

- Tax Credit (7)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Exempt (1)

- Tax Holiday (1)

- Tax Interns (2)

- tax services (28)

- taxes (45)

- Taxes - Corporate & Business (107)

- Taxes - Individual (124)

- Taxes - Planning, Rules and Returns (197)

- TechCred (1)

- technology (8)

- The CARES Act (6)

- The SOURCE (1)

- tiag (3)

- transaction advisory (2)

- Treasury Department (5)

- Trump Account (1)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unclaimed Funds (1)

- Unemployment Benefits (4)

- Unemployment Insurance (1)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (35)

- Zinner News (32)