With school just a few weeks away, many parents are in the thick of back-to-school shopping. The thought of spending countless hours in the stores and comparing sale prices online to save on pencils, paper, book bags and school clothes can be daunting.

Fortunately, the State of Ohio has renewed legislation allowing for a second sales tax holiday, August 5 – 7, 2016. This sales tax holiday only applies to certain types of goods purchased from 12:01 am August 5th through 11:59 pm August 7th.

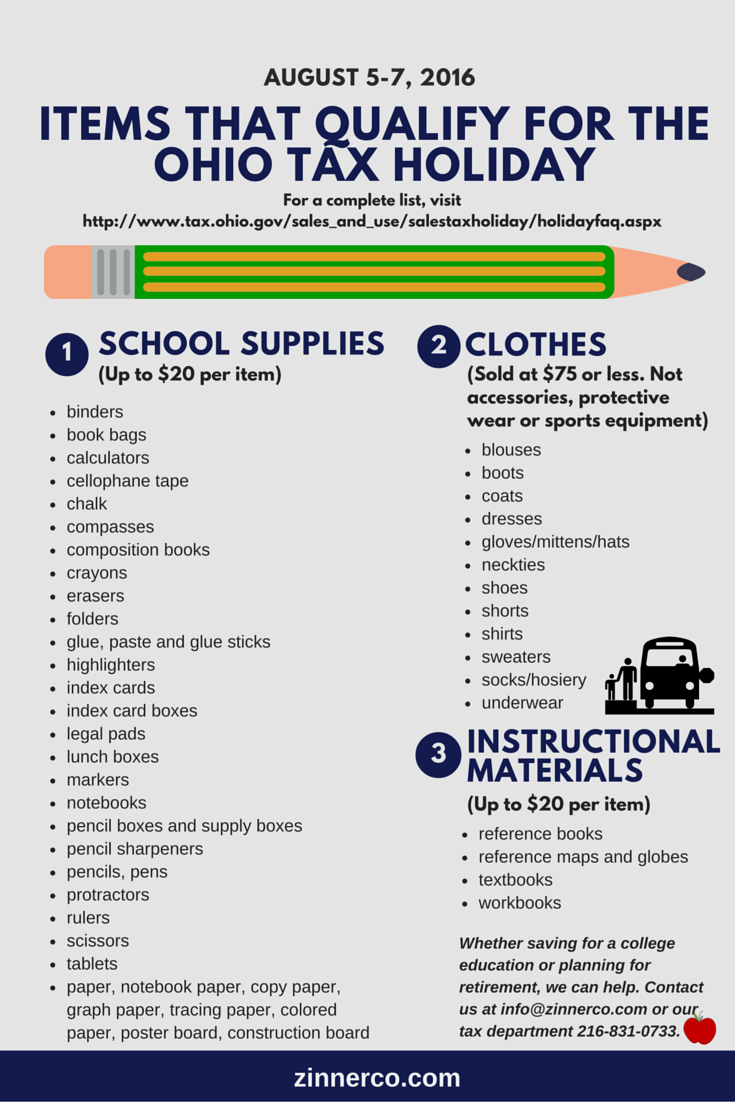

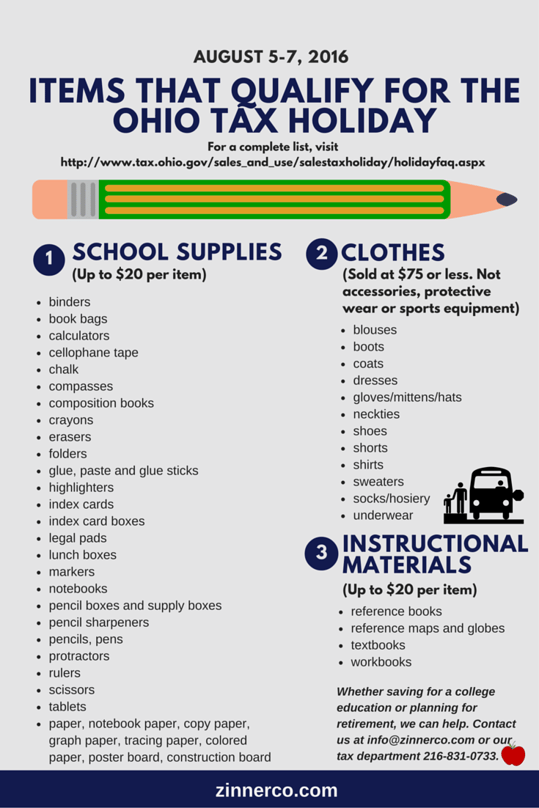

The categories include…

- Clothing – Up to $75 per item

- School supplies – Up to $20 per item

- Reference and workbooks – Up to $20 per item

Clothing includes an extensive list of qualified apparel, including items such as wedding dresses and diapers. However, for the sales tax holiday, clothing does not include clothing accessories, protective equipment, sewing equipment & supplies, sports & recreational equipment, belt buckles (sold separately), costume masks (sold separately), or patches & emblems. Most commonly required school supplies and reference materials qualify for the sales tax holiday exemption.

For a more detailed list of qualified and disqualified goods, please visit the Ohio Department of Taxation’s Sales Tax Holiday FAQ’s page (http://www.tax.ohio.gov/sales_and_use/salestaxholiday/holidayfaq.aspx).

Not only will the sales tax holiday help parents save some money buying their children’s school supplies and clothes, but also, anyone purchasing any of the qualified items listed above during the weekend. It should be noted, however, anything purchased for use in a trade or business does not qualify for the sales tax holiday. The price limitations by type are on a per good basis. The retailer may not split the cost of a typically sold good (i.e., you cannot have someone split the price of a pair of shoes and charge you for each shoe to meet the price limitation). Also, if you encounter a “buy one, get one free” or “buy one, get one half off” deal, you cannot average the price over the two items.

The limitation does, however, apply after the use of coupons. So, if you are able to meet the cost limitations after the use of a coupon, that item will qualify. All internet orders for qualified goods qualify for the sales tax exemption, so long as the transaction occurs within the time period of the sales tax holiday, regardless of when the items are actually shipped.

Adding up the savings

Considering the combined sales tax rate for Cuyahoga County is 8%, the savings may not seem like much. However, the National Retail Federation is predicting a family with children in school from K to 12 will spend an average of $674 on back-to-school shopping.

If you were to assume you spent that without a sales tax holiday, your bill would come to $728, assuming you live in Cuyahoga County. Therefore, should you spend $674 on qualified items during the sales tax holiday; you would save $54 in sales tax you would otherwise have to pay.

As you can see, the Ohio Sales Tax Holiday is something to celebrate. If you have questions on the taxation, education planning or ways in which you can reduce your taxable income, contact our professionals at 216.831.0733. We are ready to start the conversation and help you and your family or business build a solid financial future.