Like many taxpayers, you may have recently (or routinely) donated a few bags of clothing and household items to a 501(c)(3) charitable organization. The $125 designer jeans, a box of barely-used stuffed animals, and eclectic wall art were sought-after purchases that found their way to your home through your hard-earned dollars. Certainly, your goods were priceless treasures to you and you presumed the same for the lucky charity to which you would donate them.

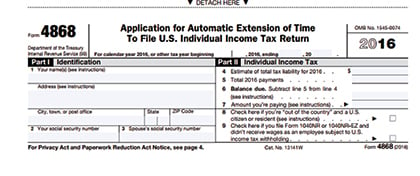

Each year, some taxpayers find themselves scrambling to find their income tax return paperwork, a year's worth of receipts, and ultimately becomes stressed in the attempt to file their tax return by April 18. Others know and understand that simply filing a tax extension can earn them time, reduce their stress, and possibly, incur a lower tax bill.

Do you remember when you were in school and the teacher would give each student a worksheet to “spot the difference” between two side-by-side detailed scenes? You would look carefully at each of the two images, trying to spot subtle details, such as an extra button on a shirt or a missing shoe on a person. Maybe it was the number of petals on a daisy or a cone of ice cream missing the cherry on top. The directions would indicate there would be six differences, but try as hard as you did, (and even when you asked a classmate for help) you could still only find four or five differences, and were convinced there was never a sixth.

Published January 24 2017, 12:59pm EST

AccountingToday.com

Tax Return Planning Guide: Download Your Free Ebook

Zinner & Co. tax services , Taxes - Corporate & Business , Taxes - Individual| It's that time of year again when most are thinking about filling out their tax return. Many are sifting through shoeboxes full of receipts, others, wondering if they have a receipt. |

What You Must Know if You Are Planning to Hire Employees in the Coming Weeks

Zinner & Co. Taxes - Corporate & Business , Business - Management, Issues & ConcernsIf you are an employer planning to add to your workforce, you need to know about the recent change regarding Form I-9, the Employment Eligibility Verification form. Form I-9 is compulsory for all employers to confirm every newly hired employee’s identity and that they are authorized to work in the United States.

Why You Will Not Receive a Tax Refund Before February 15

Barbara Theofilos, CPA, MBA fraud , Barbara Theofilos , Taxes - Individual , income taxOn December 18, 2015, President Obama signed legislation called “Protecting Americans from Tax Hikes” Act of 2015, or the PATH Act for short.

The PATH Act contained many extensions and changes to existing tax laws. The Act also included a provision which will delay refunds for certain taxpayers. The IRS is now required to not issue a refund to anyone claiming the Earned Income Tax Credit or the Additional Child Tax Credit until February 15. Both of these refunds are considered “refundable credits,” which are essentially treated as additional tax payments, and can reduce one’s tax liability below zero. More, the PATH Act was enacted to give the IRS more time to review refund claims, in an effort to reduce fraud and catch refunds that may be improperly issued.

Do you have questions about the PATH Act, your refund, or income tax preparation? Let's talk! Contact me at btheofilos@zinnerco.com or any of the professionals here at 216.831.0733. We're ready to start the conversation and end the confusion.

6 Things to Keep in Mind if You Receive a Notice from the IRS

Eric James Taxes - Corporate & Business , Taxes - Individual , IRS , Eric JamesFor some, a simple flip through the day’s mail can soon turn into a panic-producing event. Bad news, bill collectors, or worse, a tax notice from the IRS, state department of taxation, or the local tax agency.

How the 65th Day of the New Year Could Help You Save on your Taxes

Zinner & Co. Tax Department Taxes - Individual , Estates, Gifts & TrustsThe benefits of trusts in managing one’s financial affairs, both during one’s life and after one’s death, are well documented and quite significant. Among the trade-offs for their benefit are the complexity of their tax structure and the highly compressed tax brackets that apply to them. In addition, it is important to note that estates are subject to most of the same tax treatment as trusts.

Education Celebration: 3 Cheers for the new FAFSA!

Eric James Financial Planning - College , Eric JamesThe new 2017 Federal Application for Student Aid (FAFSA) is now available and for many applicants, especially those renewing their FAFSA, the improved process and streamlined criteria is a welcome change.

About Us

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Categories

- 1031 Exchange (2)

- 401k (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (13)

- audits (8)

- Bank Secrecy Act (1)

- banks (1)

- Barbara Theofilos (6)

- Beneficial Ownership Information (1)

- Bitcoin (1)

- block chain (2)

- BOI (3)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (51)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Charitable Donations (2)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Compliance (1)

- Coronavirus (24)

- Corporate Transparency Act (1)

- COVID-19 (30)

- Credit card fraud (5)

- credit reporting (2)

- cryptocurrency (2)

- CTA (2)

- cybersecurity (17)

- dead (1)

- DeAnna Alger (6)

- death (2)

- debt (4)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (2)

- Digital Tax Payment (3)

- divorce (4)

- DOMA (3)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- EIDL (1)

- electronic filing (4)

- Electronic Tax Payments (3)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (3)

- Employee or Independent Contractor (6)

- Employee Retention Credit (3)

- employment (2)

- ERC (3)

- Eric James (8)

- Estates, Gifts & Trusts (48)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FASB (1)

- FBAR (1)

- FDIC coverage (1)

- Federal Assistance (4)

- filing (3)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- FMLA (1)

- foreign assets (3)

- fraud (38)

- FSA (1)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- HDHP (2)

- health care (3)

- home (2)

- home office (1)

- Howard Kass (2)

- HRA (1)

- HSA (5)

- identity theft (34)

- income (1)

- income tax (58)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- Intuit (1)

- investments (4)

- IRS (91)

- jobs (5)

- John Husted (1)

- K-1 (1)

- Laura Haines (3)

- Layoff (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- LLC (3)

- Loans (2)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- NAIOP (1)

- National Defense Act (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- OATC (1)

- OBBB (3)

- ODJFS (1)

- office (1)

- ohio (13)

- Ohio Accounting Talent Coalition (1)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (4)

- Ohio Department of Taxation (7)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Ohio Society of Certified Public Accountants (1)

- One Big Beautiful Bill (10)

- Online Tax Payment (4)

- Operations (2)

- OPERS (1)

- OSCPA (1)

- Overtime (2)

- owners of foreign entities (1)

- partnerships (5)

- passwords (1)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- ppp (7)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (14)

- record retention (2)

- records (2)

- Reporting (1)

- Republican National Convention (1)

- Retirement Planning & IRAs (54)

- Richard Huszai, CPA (5)

- RITA (1)

- Robin Baum (6)

- RRF (1)

- S Corporation (1)

- SALT (8)

- SBA (8)

- scams (14)

- SECURE 2.0 Act (1)

- security (6)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- SMB (12)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- spouse (1)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- SVOG (1)

- tangible property (1)

- tax (27)

- tax avoidance (12)

- Tax Credit (7)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Exempt (1)

- Tax Holiday (1)

- Tax Interns (2)

- tax services (28)

- taxes (45)

- Taxes - Corporate & Business (107)

- Taxes - Individual (125)

- Taxes - Planning, Rules and Returns (198)

- TechCred (1)

- technology (8)

- The CARES Act (6)

- The SOURCE (1)

- tiag (3)

- transaction advisory (2)

- Treasury Department (5)

- Trump Account (1)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unclaimed Funds (1)

- Unemployment Benefits (4)

- Unemployment Insurance (1)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (35)

- Zinner News (32)