So through some miracle, you ended up with enough healthy players at the end of your season to triumph in your fantasy football championship. Although you may still be riding that high, like yours truly, it’s good to know how this may or may not affect your tax return for this year. With fantasy football becoming ever more popular year after year, it’s becoming a larger target to the IRS.

5 Things You Need to Know About Naming a Beneficiary

Zinner & Co. Tax Department Estates, Gifts & TrustsAs busy professionals, caregivers, and the like, we tend to put off until tomorrow that which isn't deemed critical today. One such item that we cannot afford to delay is the filing of a beneficiary designation form.

If Your Kids Attended Summer Camp, You Could Save on Your Taxes

Laura Haines, CPA and Andres Rios Taxes - Individual , deductions , Laura HainesAs summer winds down, many parents are now facing the reality of what their summer child care costs actually totaled. Surprisingly, it is quite significant. When registering little Timmy for day camp back in the spring, the $250 early-bird fee seemed so insignificant. In addition to the weekly cost of camp, there were a variety of incidental costs, such as concession stand monies, field trip fees, souvenir dollars and three replacement swim goggles that contributed to a very shocking bottom line.

Check Your Tax Withholding this Summer to Prevent a Tax-Time Surprise

Zinner & Co. Tax Team Taxes - Individual , IRSEach year, many people get a larger refund than they expect. Some find they owe a lot more tax than they thought they would. If this has happened to you, review your situation to prevent a tax surprise. Did you marry? Have a child? Change in income? Life events can have a major impact on your taxes. Bring the taxes you pay closer to the amount you owe. Here are some tips to help you come up with a plan:

Recently, pop star Iggy Azalea discovered (the hard way) that even though you might an iconic pop star, you still have to pay your fair share of taxes on earnings.

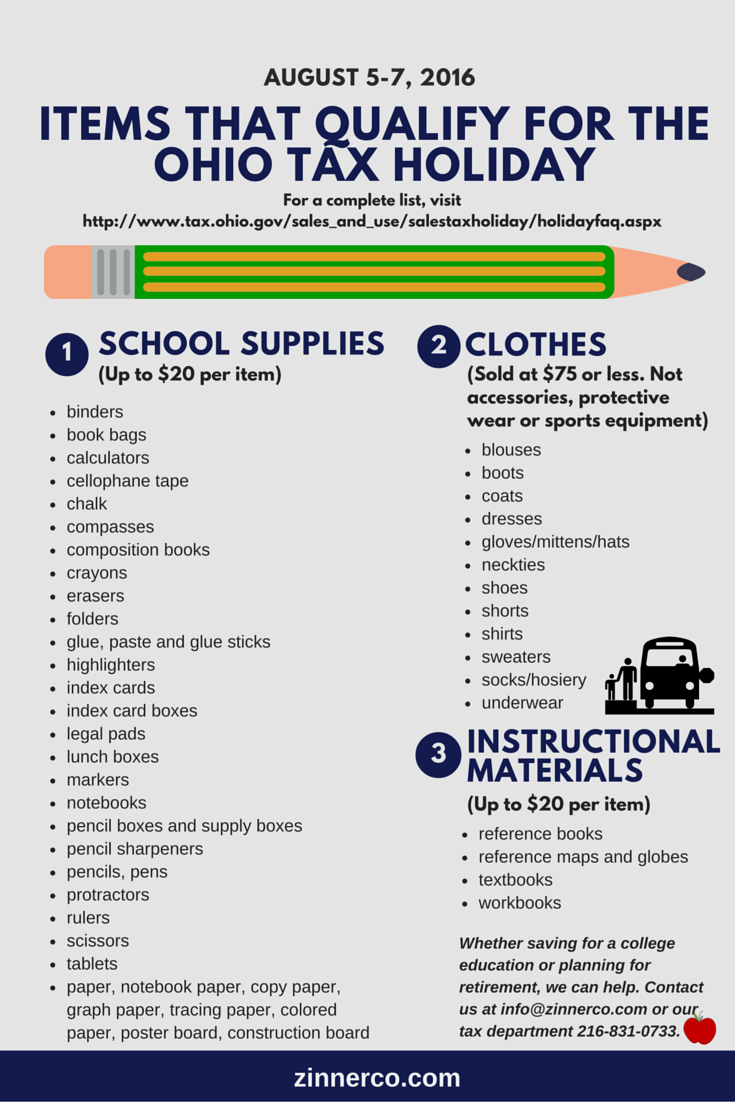

Back-to-School Sales Tax Holiday: What You Need to Know That Can Save You Dough

Zinner & Co. Tax Department education , Taxes - IndividualWith school just a few weeks away, many parents are in the thick of back-to-school shopping. The thought of spending countless hours in the stores and comparing sale prices online to save on pencils, paper, book bags and school clothes can be daunting.

Fortunately, the State of Ohio has renewed legislation allowing for a second sales tax holiday, August 5 – 7, 2016. This sales tax holiday only applies to certain types of goods purchased from 12:01 am August 5th through 11:59 pm August 7th.

Looking for a gift to give after all those June weddings? How about some solid tax advice for the newlyweds?

Does your Organization Have a Conflict of Interest?

Chris Valponi, CPA non-profits , non-profit reporting , Chris ValponiMany not-for-profit organizations struggle to find qualified financial leaders for their boards. Often individuals possessing higher-level financial experience are asked to take on multiple roles, begging the question, “can a board member be both the treasurer and the chair of the audit committee”?

Can You Borrow Money from your Retirement Account ... and Should You?

Zinner & Co. Tax Department Taxes - Individual , Retirement Planning & IRAsSo you’ve finally had enough of the hype and are determined to score a pair of tickets to see “Hamilton” for Lin-Manuel Miranda’s final performance as the lead. Tickets selling through ticket brokering sites are going for outrageous prices, and you’re a bit short on cash. Should you embark on a personal revolution and loot your retirement accounts to go?

In a recent article, we addressed the exceptions to the early withdrawal penalty on IRA distributions taken prior to an individual reaching age 59 1/2. In such a case, the IRA distribution would still be subject to federal income tax and, potentially, state income tax, and would result in permanently removing those assets from the IRA, having a negative impact on the availability of future retirement income.

So, if you need a quick cash infusion and do not want to suffer the income tax ramification of an IRA distribution, what can you do? One option would be to take a loan from your retirement account. While an advisor may not typically recommend that an account owner borrow from their retirement account, a loan from one’s retirement can have both benefits and costs, as discussed below:

Summer Wedding? 6 Ways Getting Married Will Affect Your Taxes

Richard Huszai, CPA Taxes - Individual , Richard Huszai, CPA , IRSIt's here. Your summer wedding, long in the planning and preparation phase, has finally arrived. You've spent many months knee-deep in details, from the "will you marry me" or "I will's" to selecting the first song you dance to as husband and wife. You've bickered and resolved the guest list, swallowing your pride to allow crazy Aunt Alice to the reception even though you would rather not, and begrudgingly penning "and guest" to your best friends invitation even though you think their choice is less-than-stellar.

In the end, there is one person who many couples usually forget to include when budgeting for a wedding and finalizing the guest list: Uncle Sam.

Yes, there are tax issues that come along with getting married. Here are six basic tips courtesy of the IRS to help you on your road to wedded bliss:

About Us

Since 1938, Zinner has counseled individuals and businesses from start-up to succession. At Zinner, we strive to ensure we understand your business and recognize threats that could impact your financial situation.

Recent Blog Posts

Categories

- 1031 Exchange (2)

- 401k (2)

- 529 plan (4)

- ABLE Act (1)

- account systems (3)

- accounting (8)

- Affordable Care Act (8)

- alimony (2)

- American Rescue Plan Act (1)

- Ask the Expert (5)

- Audit and Assurance Department (13)

- audits (8)

- Bank Secrecy Act (1)

- banks (1)

- Barbara Theofilos (6)

- Beneficial Ownership Information (1)

- Bitcoin (1)

- block chain (2)

- BOI (3)

- Bookkeeping (1)

- Brett W. Neate (28)

- budgets (1)

- Bureau of Worker's Compensation (12)

- Business - Management, Issues & Concerns (51)

- business income deduction (3)

- business succession (7)

- business travel expense (3)

- business valuation (5)

- capital gains (2)

- careers (7)

- cash flow (2)

- Charitable Donations (2)

- Child Tax Credit (2)

- Chris Valponi (8)

- City of Cleveland (1)

- Cleveland COVID-19 Rapid Response Fund (1)

- Cleveland Rape Crisis Center (2)

- college (3)

- Community (24)

- Compliance (1)

- Coronavirus (24)

- Corporate Transparency Act (1)

- COVID-19 (30)

- Credit card fraud (5)

- credit reporting (2)

- cryptocurrency (2)

- CTA (2)

- cybersecurity (17)

- dead (1)

- DeAnna Alger (6)

- death (2)

- debt (4)

- deductions (14)

- Deferring Tax Payments (4)

- Department of Job and Family Services (2)

- depreciation (2)

- Digital Tax Payment (3)

- divorce (4)

- DOMA (3)

- Economic Impact Payments (2)

- Economic Injury Disaster Loan (4)

- education (8)

- EIDL (1)

- electronic filing (4)

- Electronic Tax Payments (3)

- Emergency Working Capital Program (1)

- employee benefit plan auditor (1)

- Employee Leave (3)

- Employee or Independent Contractor (6)

- Employee Retention Credit (3)

- employment (2)

- ERC (3)

- Eric James (8)

- Estates, Gifts & Trusts (48)

- expenses (5)

- Families First Coronavirus Response Act (2)

- FASB (1)

- FBAR (1)

- FDIC coverage (1)

- Federal Assistance (4)

- filing (3)

- financial planning (8)

- Financial Planning - College (9)

- financing (3)

- Firm news (119)

- first responders (1)

- FMLA (1)

- foreign assets (3)

- fraud (38)

- FSA (1)

- fundraising (9)

- Gabe Adler (1)

- gift tax (5)

- HDHP (2)

- health care (3)

- home (2)

- home office (1)

- Howard Kass (2)

- HRA (1)

- HSA (5)

- identity theft (34)

- income (1)

- income tax (58)

- independent contractor (1)

- Inflation (1)

- Insurance (7)

- internal control (4)

- international (2)

- Intuit (1)

- investments (4)

- IRS (91)

- jobs (5)

- John Husted (1)

- K-1 (1)

- Laura Haines (3)

- Layoff (2)

- Layoffs (1)

- leadership (3)

- lease accounting standards (1)

- life insurance (1)

- LLC (3)

- Loans (2)

- longevity income annuities (1)

- Lorenzo's Dog Training (1)

- Magic of Lights (1)

- management advisory (3)

- manufacturing (2)

- Matt Szydlowski (3)

- medical (7)

- Medicare (2)

- mergers and acquisitions (1)

- Mike DeWine (2)

- Millennial Concepts (2)

- minimum wage (1)

- NAIOP (1)

- National Defense Act (1)

- non-profit reporting (10)

- non-profits (38)

- not-for-profit (26)

- OATC (1)

- OBBB (3)

- ODJFS (1)

- office (1)

- ohio (13)

- Ohio Accounting Talent Coalition (1)

- Ohio business owners (18)

- Ohio Department of Jobs and Family Services (4)

- Ohio Department of Taxation (7)

- Ohio Incumbent Workforce Training Voucher Program (1)

- Ohio Society of Certified Public Accountants (1)

- One Big Beautiful Bill (10)

- Online Tax Payment (4)

- Operations (2)

- OPERS (1)

- OSCPA (1)

- Overtime (2)

- owners of foreign entities (1)

- partnerships (5)

- passwords (1)

- Paycheck Protection Program (9)

- payroll (8)

- penalties (3)

- pension (2)

- personal finance (2)

- planning (4)

- ppp (7)

- Productivity (5)

- Qualified Business Income (1)

- quickbooks (10)

- real estate (14)

- record retention (2)

- records (2)

- Reporting (1)

- Republican National Convention (1)

- Retirement Planning & IRAs (54)

- Richard Huszai, CPA (5)

- RITA (1)

- Robin Baum (6)

- RRF (1)

- S Corporation (1)

- SALT (8)

- SBA (8)

- scams (14)

- SECURE 2.0 Act (1)

- security (6)

- SharedWorks (1)

- Shutdown (3)

- Silver Linings (9)

- simplified employee pension (1)

- Small Business (5)

- SMB (12)

- Social Media (1)

- social security (4)

- Speaker Series (2)

- spouse (1)

- start ups (8)

- Stay at Home Order (3)

- Steven Mnuchin (1)

- Sue Krantz (6)

- SVOG (1)

- tangible property (1)

- tax (27)

- tax avoidance (12)

- Tax Credit (7)

- Tax Cuts and Jobs Act of 2017 (31)

- Tax Exempt (1)

- Tax Holiday (1)

- Tax Interns (2)

- tax services (28)

- taxes (45)

- Taxes - Corporate & Business (107)

- Taxes - Individual (125)

- Taxes - Planning, Rules and Returns (198)

- TechCred (1)

- technology (8)

- The CARES Act (6)

- The SOURCE (1)

- tiag (3)

- transaction advisory (2)

- Treasury Department (5)

- Trump Account (1)

- tuition (3)

- U.S. Department of the Treasury (1)

- U.S. Small Business Administration (6)

- Unclaimed Funds (1)

- Unemployment Benefits (4)

- Unemployment Insurance (1)

- withdrawls (2)

- withholding (6)

- Workers Comp Billing Changes (1)

- Zinner & Co. (35)

- Zinner News (32)