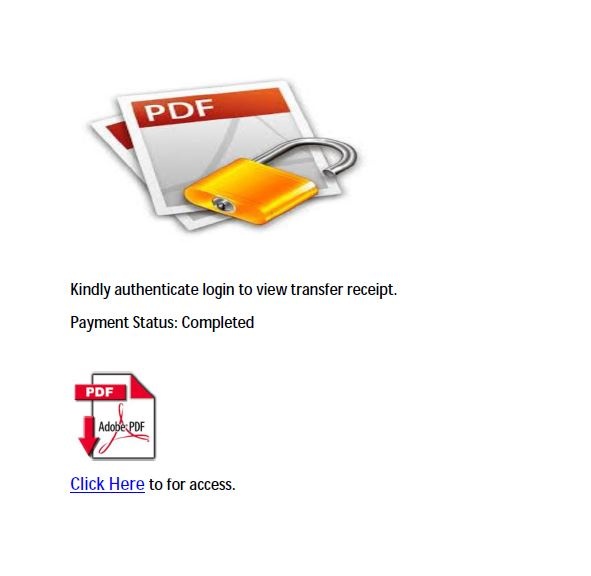

There's a threat called Phishing and it can put your entire organization at risk. Phishing, a technique malefactors use to steal sensitive information such as user names and passwords, is a growing segment of crime.

Phishing typically involves the use of an authentic-looking email or website that prompts you to enter sensitive data that can be used to hack or hijack your business's systems. Phishing techniques are becoming increasingly sophisticated and more difficult to spot and prevent.